With a reported £112 billion tied up in late payments (according to recent research from Sage and CEBR), and increasing economic uncertainty in the UK, a perfect storm is brewing for SMBs.

The research was conducted by Centre for Economics and Business Research, who analysed over 1.2 million anonymised invoices from 31,000 Sage customers, revealing that 44% of invoices are paid late, and the average SME is owed £42,000 in overdue invoices.

This is an eye-watering amount – and a figure that has consistently increased over three consecutive years. It’s not just small businesses’ resilience that’s being tested, but their ability to plan, invest and grow with confidence.

We know that late payments result in limited productivity and choke cashflow, which are all part of the broader economic slowdown, but it’s also a vicious cycle that’s difficult for SMBs to escape from. At Escalate, we speak to businesses every day who are suffering the fall out from late payments and the knock-on effect it’s had on their operations.

The scale of this problem needs a new approach, because the current status quo clearly isn’t working. Every few years a new late payment study is commissioned, with the outcome generally worse than the one before. While figures vary, multiple studies from 2019 suggested that the extent of late payments ranged from £23.4 – £131 billion owed to small businesses.

A recent and notable shift is the added pressure from higher NI rates and increased minimum wages introduced in April 2025. While many businesses have already cut costs and raised prices, these recent changes leave little room in the budget – and limited cashflow to absorb late payments. An unexpectedly overdue invoice could now be the final straw.

Stopping late payments from turning into bad debt write-offs

A late payment that isn’t recovered doesn’t necessarily make it a bad debt – just a good debt not recovered! By contrast, a bad debt is when a company can’t pay, not when it won’t or doesn’t. In many cases it’s because the debtor is under financial pressure themselves, and simply can’t afford to pay right now.

It’s crucial to properly qualify whether the outstanding sum really is a bad debt, or simply an overdue invoice that is genuinely recoverable with some proper credit control procedures in place. Before writing off any so-called bad debt, ask yourself two questions:

- Has it just been assumed that they’re bad debts because the debtor has failed to pay after 90 days?

- Has the debt been properly qualified by a robust credit control process?

In our experience, most debtors are left to age – with some intermittent chasing from credit control – until year end, when the company’s accountant may ask management whether to make a provision for it, or write them off. More often than not, the bad debt is simply written off, because the business has neither the time, inclination, or budget to pursue it.

This is where many businesses go wrong – good debts are treated as ‘bad’, because they simply don’t (or can’t) try to recover them and subsequently write them off. It’s easier to do that than attempt to recover.

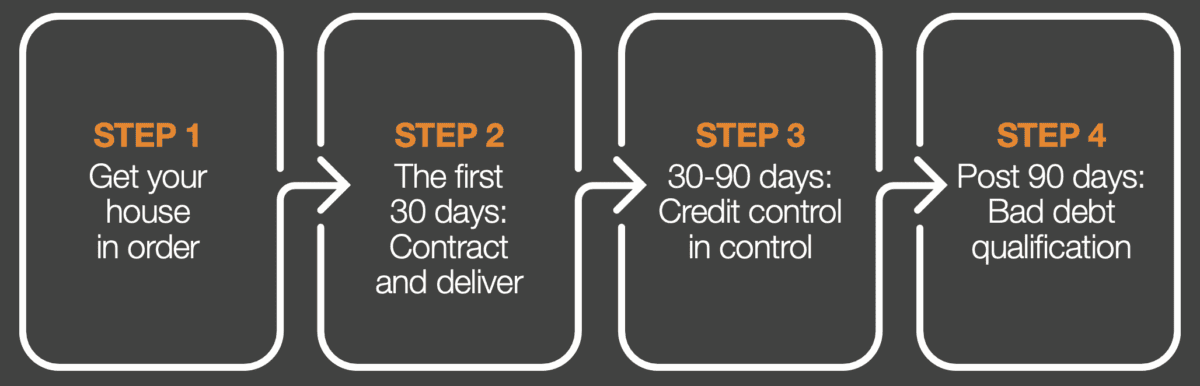

The problem is that this mindset and approach are fuelling the multi-billion-pound SMB cashflow crisis we referenced earlier. So we’ve pulled together a simple step-by-step guide (and a downloadable PDF for those who want the detail) to help you break the cycle – and unlock more of the cash you’re owed.

1. Get your house in order

One of the best investments you can make over the next 12 months is to strengthen your terms and conditions – especially if you haven’t had chance to review them for a while. A solid foundation here puts you in a stronger position to recover late payments and disputed debts.

2. The first 30 days: Contract and deliver

Issue your invoice promptly and stick to your agreed terms – usually 30 days unless stated otherwise. Most good clients will pay on time, but late or missed payments are common for any business, and should progress straight to the next step.

Taking a passive approach risks leaving it too late to recover what you’re owed. But by acting early, you can get ahead of other creditors and rising cost pressures that might otherwise block any chance of recovery.

3. 30-90 days: Credit control in control

Payment hasn’t arrived, and whether it’s a late payment or breach of contract, the fact remains: you’re owed money.

- If you don’t have a formal credit control process, put one in place now. Plenty of clear, step-by-step templates are available online.

- If you do have one, follow it – no exceptions. It doesn’t need to be aggressive, but it must be firm and focused on recovery.

- No payment or agreed payment plan in place by day 90? Move to Step 4.

4. Post 90 days: Bad debt qualification

Once payment is over 60 days late, it’s time to face one of two likely realities:

- Your client is struggling. They’re probably behind with other suppliers too. In this case you need to act quickly – in our experience, the first to move usually recovers the most.

- Your client doesn’t value you. They’re choosing to pay others first. Ask yourself: are they worth trading with if they ignore your agreed terms? Strong, immediate action can often reset the relationship – or confirm it’s not worth saving. Either way, act now.

Don’t waste time repeating your credit control process beyond 90 days.

Once the three-month mark has passed, it’s about taking formal action to recover payment – or qualifying it as a genuine bad debt write-off. Here’s what we suggest:

- Write to the client requesting full and final payment within seven days. Make it clear that, failing this, legal action will begin. If they wish to dispute the payment, they must do so in writing within the same timeframe.

- If they offer a payment plan you’re happy with, accept it – but formalise the agreement in writing. Don’t hesitate to ask for improved terms or added security in return.

- If they dispute the payment, then provide a formal response. Remind them no issues were raised over the previous three months and request immediate full payment. More often than not, these are just delay tactics – not real concerns – because genuine issues with the service or product provided would have been identified earlier on in the credit control process.

- If you can’t secure payment or agree a payment plan, it’s time to move into recovery. Inaction and empty threats are what fuels the current late payment culture, so it’s important to note that you must follow through with your plan.

- At this point, you’ll need to appoint outside help. Escalate or an equivalent service can quickly determine if a recovery is possible, or whether you need to accept it is a bad debt write-off.

- If your claim is viable and the debtor is able to pay, a fully-funded solution such as Escalate removes your financial risk, so that you can pursue recovery with confidence and account for payment accordingly. Remember that a partial recovery through a third-party like ourselves is always better than a write-off.

- If recovery is deemed impossible (for example, there are no funds left in the company because it’s gone into liquidation), then you can write-off the debt, deal with the tax implications and move on.

This is what strong, efficient cashflow management looks like. As a director, it shows you’re taking clear, responsible steps to protect the company’s assets, and most importantly, you can do this alongside a real-time process rather than an annual clean up of debtors.

Don’t fall into the bad debt write-off trap

Now more than ever, having a clear, firm process to manage late payments and commercial disputes is essential.

Too many businesses let a missed 30-day payment drift into a vague credit control process that drags on for 12 months, before finally writing the payment off. While this might be manageable for the occasional low-value invoice, it’s not a sustainable practice and the long-term cash flow impact can be significant.

Escalate was created because too many disputes and bad debts were being buried, and our all-in-one packaged solution remains unique in the market. We provide built-in legal expertise, case funding, and full cost protection if the case is unsuccessful – all for a capped fee that’s only payable on success and ensures you remain the main beneficiary of any recovery. Our team can quickly confirm whether recovery is possible – freeing up your valuable time so you can focus on your business.

If you’d like to get in touch with one of the Escalate team to discuss an unresolved dispute or late payment, please contact us on 0207 039 1950 or email us. View our PDF guide to avoiding the write-off trap.

< News & Views

CONTACT US

Contact Us to find out more about how Escalate can help your business.

Exchange Station, Tithebarn Street, Liverpool,

L2 2QP (Registered office)

London office: 5th floor, 15 Westferry Circus, London, E14 4HD

Escalate Law Limited

Company No: 10381993

Authorised and regulated by the Solicitors Regulation Authority

Escalate Law Limited (No: 650666)